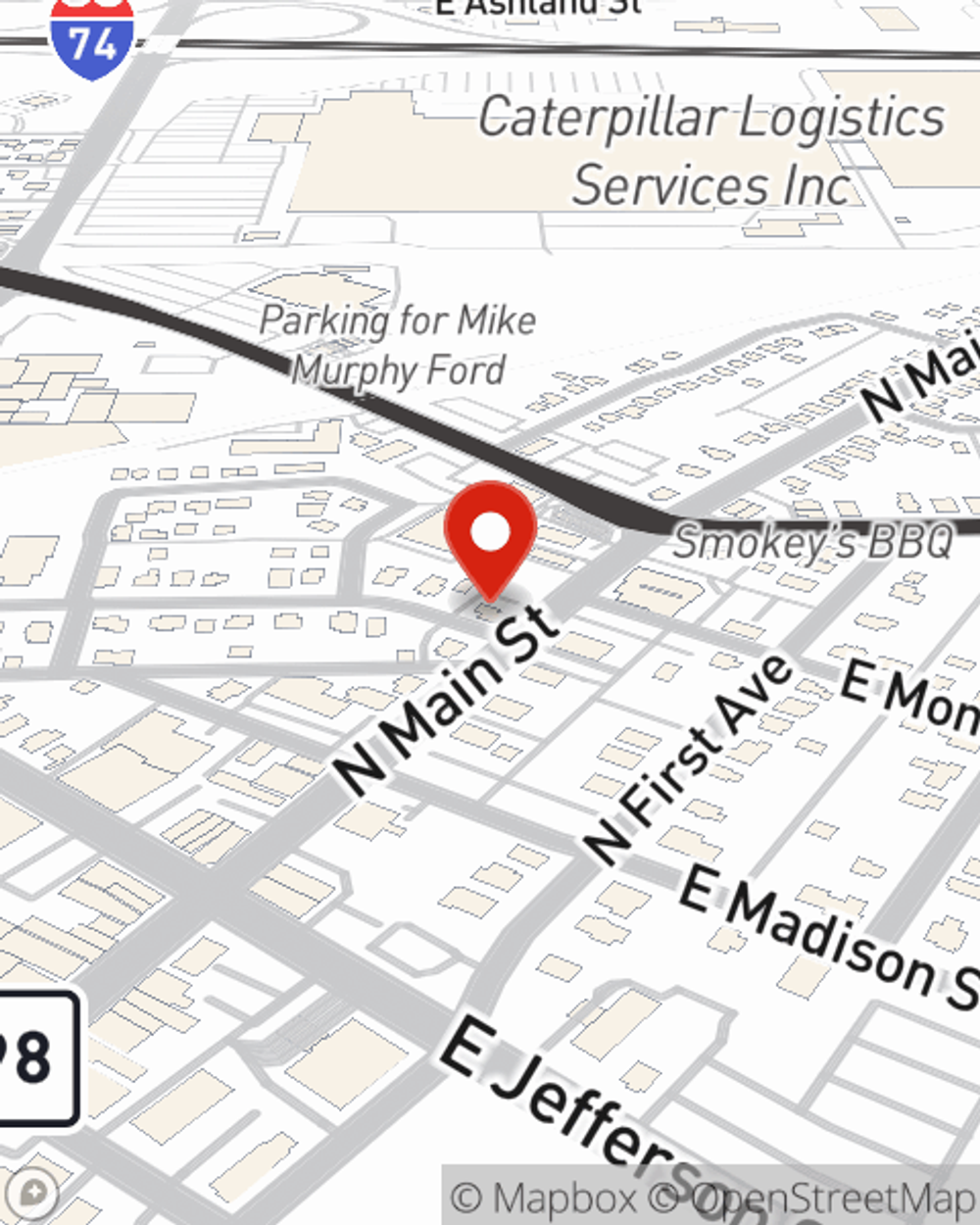

Life Insurance in and around Morton

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

Investing in those you love is what keeps you going every day. You go to work to provide for them help them make decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Protection for those you care about

Now is the right time to think about life insurance

Wondering If You're Too Young For Life Insurance?

Some of your options with State Farm include coverage for a specific number of years or level or flexible payments with coverage designed to last a lifetime. But these options aren't the only reason to choose State Farm. Agent Brad Monroe's empathetic customer service is what makes Brad Monroe a great asset in helping you choose the right policy.

Simply get in touch with State Farm agent Brad Monroe's office today to learn more about how a State Farm policy can work for you.

Have More Questions About Life Insurance?

Call Brad at (309) 263-2371 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Brad Monroe

State Farm® Insurance AgentSimple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.